Cash Flow Forecasting

Cash is the lifeblood of any business. Therefore, forecasting cash flow is crucial, whether you are a start-up or an established company. A cash flow forecast is a projection of a business’s cash inflows and outflows over a specific period. It plays a vital role in ensuring the financial health of a business.

Why is cash flow forecasting important?

- It helps prevent potential cash shortfall

Being able to predict when money will come in and when expenses are due helps businesses avoid surprises and ensures there is sufficient funding to cover essential operating costs.

Cash flow forecasting helps predict potential liquidity gaps in the future and allows businesses to address issues before they become critical. Identifying potential cash shortages early on gives time for businesses to communicate proactively with clients and suppliers, reducing the risk of incurring late fees and preserving relationships. Some examples of the actions that business owners may take are negotiating with suppliers for extended payment terms or requesting customers for early collection.

- It supports decisions regarding growth plans

Decisions about expansion, hiring, and investing all require cash funding. By having a clear view of the business' cash flow situation, an informed decision can be made regarding the timing and the extent of the growth plans. For example, an expansion plan might have to be pushed back or scaled down if it is anticipated that the cash position will be tight.

How to build a cash flow forecast?

Forecasting cash flows involves predicting the expected inflows and outflows of cash for a specific period. The goal is to project how much cash your business will have on hand and make decisions based on that information. You can build a simple cash flow forecast using the structure below:

1. Beginning Cash Balance: The starting balance at the beginning of each forecast period.

2. Cash Inflows: Include all the sources of cash from where your business expects to receive. Common inflows include:

- Revenue: Estimate the expected revenue from clients or customers by taking into consideration the following factors:

- Sales volume: Project the unit sales per product category or service offered. To do this, analyze the historical data, current trends, and planned marketing efforts.

- Pricing: Include any projected price increases or promo offerings and their timing.

- Payment terms: Factor in when the payment from the customer is expected to come in based on the agreed credit terms. For example, a sale made in January with a 30-day credit term should be plotted in the February cash inflows. Further, examine the payment history of customers to determine their payment patterns and account for possible payment delays.

- Seasonality: The periods where there are expected slowdowns or increased activities should also be plotted in the cash flow forecast.

- Loan drawdown

- Capital infusion from owners

- Sale of company’s assets

- Tax/payment refund

- Revenue: Estimate the expected revenue from clients or customers by taking into consideration the following factors:

3. Cash Outflows: Cash outflows include all the payments your business needs to make. Common outflows include:

- Cost of Goods Sold (COGS): Expenses that are directly related to the production of goods or services sold, such as materials and labor. Some of these expenses vary directly with your projected sales volume.

- Operating Expenses: Expenses that are not directly related to the goods or services sold, but are necessary to maintain the business operations, such as Office Rent and Supplies, Admin Payroll, Insurance, Legal & Professional fees, etc.

- Taxes: Income taxes, VAT, local and business taxes, etc.

- Loan payment: Repayment of business loans or credit lines, including their corresponding interests

- Capital Expenditures: Purchase of new equipment, properties, or other long-term investment

How to estimate outflows:

- Track the exact due dates of recurring business expenses and any known upcoming payments.

- Estimate the costs and timeline related to anticipated new initiatives, such as hiring additional staff or business expansion.

4. Net Cash Flow: Cash inflows minus cash outflows

5. Ending Cash Balance: Beginning cash balance + net cash flow for the forecast period.

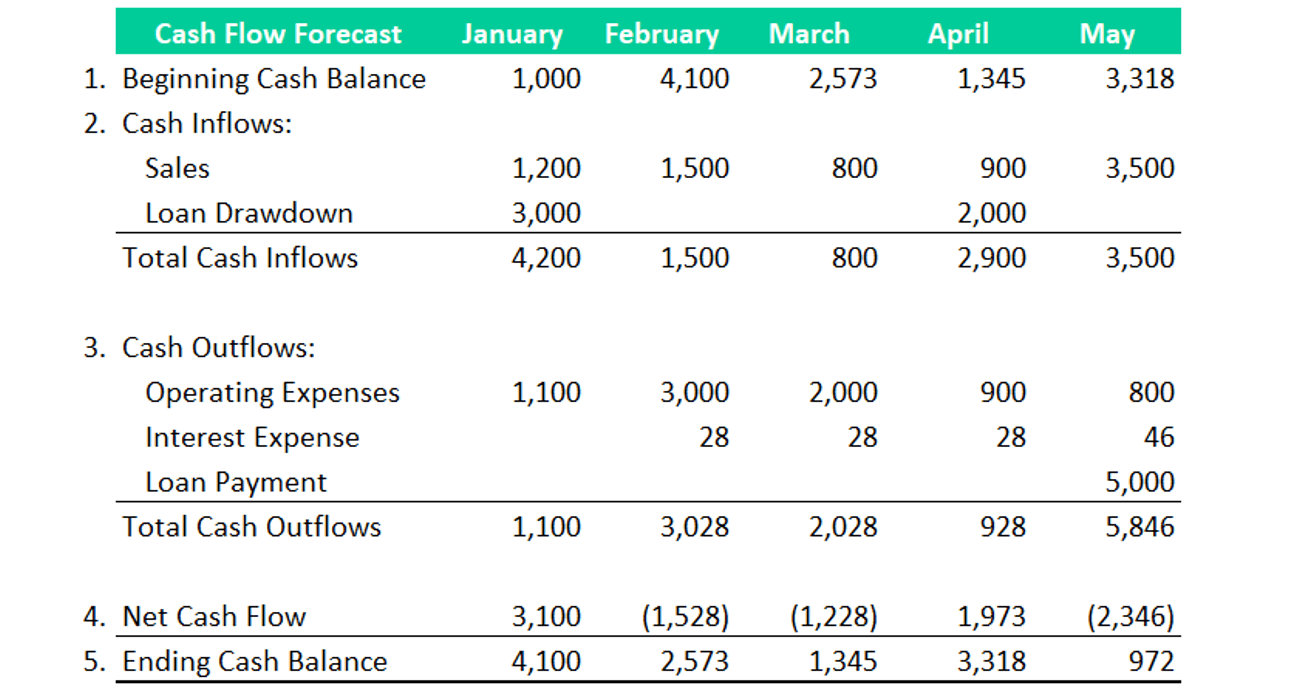

These steps provide you with the guidelines to develop a cash flow forecast that helps you avoid financial problems and enables better decision-making for your business. A put together, the output can look like this:

Cash flow forecasting is a continuous process. If you expect significant changes in sales, expenses, or payment timing, updating your cash projections will give you increased insight into the future performance of the business.

A cash flow forecast should ideally inform decision-making and help inform the company’s strategy, by first providing insight into the current trajectory of the business. Regularly reviewing your forecasts and identifying any variances from your initial projections will provide a significant amount of insight, while also helping you optimize the forecast going forward. By iterating on your forecast, identifying key variances, and incorporating it into your strategic decision making, you’ll develop a rhythm of making data-driven decisions with the support and buy-in of your leadership team. There is always uncertainty in business, but now you’ll be able to recognize the types of uncertainty in your business and its impact on your cash flow.

Written by Kim Mira